Please click "read more" to read English version below

請在下面按「閱讀更多」閱讀英文版本

Jan Fund Price/ 1月基金價格: $2.0046

Feb Fund Price/ 2月基金價格: $2.0035

Mar Fund Price/ 3月基金價格: $1.9963

Apr Fund Price/ 4月基金價格: $1.9965

May (Latest) Fund Price/ 5月(最新)基金價格: $2.0210

Total Market Value/ 市場總值: $2,243,912.79

Total Units 基金單位總數: 1,110,292.1752 Units

請在下面按「閱讀更多」閱讀英文版本

Jan Fund Price/ 1月基金價格: $2.0046

Feb Fund Price/ 2月基金價格: $2.0035

Mar Fund Price/ 3月基金價格: $1.9963

Apr Fund Price/ 4月基金價格: $1.9965

May (Latest) Fund Price/ 5月(最新)基金價格: $2.0210

Total Market Value/ 市場總值: $2,243,912.79

Total Units 基金單位總數: 1,110,292.1752 Units

親愛的投資者,

這個基金在6月已經成立了9年,因為我的生活愈來愈多責任,我已經決定了未來每年我只會發佈兩份基金報告:6月的周年紀念報告和1月的年度報告。不過我還是會每個月公佈基金價格,也計劃為這個基金建立一個網站,它將有兩個目的:以更透明的方式顯示資訊,同時它還將嵌入一個數據庫系統供投資者(你們)登入,這樣你就可以隨時查看你所擁有的基金單位數量以及它們的現值,設置一個系統將會長遠為我節省大量時間。

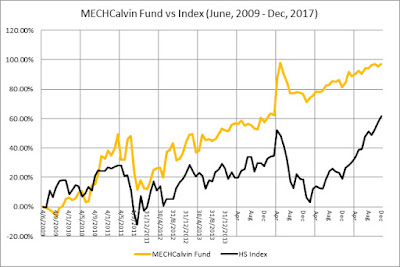

無論如何,基金價格在9年內增加了102.1%,年複合增長率為8.13%,雖然大幅打敗市場的64.67%(年複合增長率5.69%),而且高於大部分的香港基金回報,但我還是有點失望,因為我預計回報應該會在9-11%左右。在這份週年紀念報告中,我將使用經典西部牛仔電影「獨行俠決鬥地獄門 (直譯:好人、壞人、小人)」來區分在過去9年中做出的三種投資決策,以及它們如何影響我的基金績效。

《獨行俠決鬥地獄門》是1966年意大利西部史詩式電影「獨行俠三部曲」的第三部,也是最後一部,故事講述三個人物,

金髮仔(由奇連·伊士活飾演):好人,一個柔和,自信的賞金獵人

天使眼(由李·雲·奇里夫飾演):壞人,一個無情,無情,反社會的僱傭兵

圖科(由伊萊·沃勒克扮演):小人,一個滑稽狡猾,但又謹慎適應性強,口沒遮攔的墨西哥強盜

他們必須共同合作去找一個隱藏的寶藏,同時又互相爭奪希望得到所有財寶。

我覺得這是真實金融世界的戲劇性版本,所有上市公司都在市場上進行「淘金」之旅,唯一不同的是他們是否想與你分享利潤(好人),騙你的錢(壞人)和永遠把自己的利益放在首位(小人)。 在9年的經驗中,我已經經歷一切,而且整體取得了良好成果; 其中大多數都是平庸的,所以你必須從好人身上獲得最多,從壞人身上極速減少損失,並對小人保持耐性。現實不是理想中的遊樂場只有好人存在,實際上市場是一個瘋狂的西部,你必須學會並擅長生存。以下內容中我將向你展示過去9年投資生涯中,3種投資分類中的佼佼者。

1. 好人:優秀的投資和良好的業績記錄等於令人難以置信的利潤

PLUS 500

這是我投資唯一一間在英國上市的公司,它是一家在英國的另類投資市場(AIM)上市的以色列公司,提供相對較新稱為差價合約(CFDs)的金融衍生工具,這種衍生工具允許客戶使用高槓桿買入和賣出世界上基本上任何有價值的東西,其簡單機制讓投機者從市場波動中賺錢,令公司從合約獲得利潤每年幾乎翻一倍,自2013年7月上市以來,其股價已經上漲了1700%!這是非常凶狠但它不止於此,它平均每年釋放10%的股息收益,令其收益能力近乎不真實,即使過去5年內兩次下跌50%,但並沒有阻止我抱著它的決心,早知我就把所有的錢都投入這只股票。它剛被批准在倫敦證券交易所的主要市場上市; 我相信它會保持這種勢頭。

1373 國際家居零售

日本城是香港最知名的日常商品零售連鎖店之一,其股價被嚴重低估,但其每年7%的股息是和味的,公司的財務狀況良好,有大量現金,只要它的價值被市場認可,我們也將從其股價中獲利。這是彼得。林區所說的教科書例子:「它越簡單,我就越喜歡。」人們喜歡複雜和火箭科學,但往往是「簡單無聊的公司」給你最好的回報。

945 宏利金融-S

在2008年金融危機期間,對財務一無所知的我進入了保險業,宏利是我選擇的第一間的保險公司(仍然在這裡工作),2009年我通過投資宏利的共同基金開始了這個基金,我注意到管理費並不便宜於是我決定自己學習如何交易股票,而宏利正是我人生中買入的第一隻股票(代這個基金買入)。香港宏利的股價從2008年金融危機前的$350高位大幅下跌到$62,2009年又回升至$200左右,但在2011年再次受到打擊跌到$82左右,當時我知道它超賣而且跌得太多,有一天我在辦公室內,無意中聽到身後來自其他地區的區域經理(他的辦公室離我的辦公桌非常近)在電話裡說了些甚麼:「我不確定我應該現在買它(宏利的股票)還是再等!」這個對話立刻告訴我,我現在就應該採取行動,我在網上買了1000股,因為我知道他是一個投資白痴,我的直覺告訴我,當群眾猶疑時我就應該採取行動,而這位經理的猶疑讓我有信心買下我人生中的第一股。它的價格再也沒有下降,並且提供每年4-5%極端穩定的股息(每年支付4次),唯一的缺點是加拿大政府會向你收取25%的股息稅(如果你能證明你不是加拿大公民的話,可以減少到15%,但你需要做大量的文書工作而我不想煩。)

2. 壞人:希望從未做過的垃圾投資

PLUS 500

他們說:「你必須經歷失敗才能獲得成功。」在PLSU500在上市之前很久我已知它的存在,實際上我是它的客戶,試圖投機並輸了很多,這就是我理解為甚麼他們有如此強大的收益,許多像我這樣失敗的投機者就是他們成功的原因。毫無疑問,很少人可以在高槓桿衍生工具方面取得長期成功,而我就像大多數在投機中失敗的人一樣獲得了寶貴教訓。他們說:「如果你不能打敗他們,就加入他們」,衍生工具就像賭博一樣,獲勝的最佳途徑是停止賭博並投資最大贏家 - 賭場。這就是為甚麼我後來投資他們的股票而不是繼續成為愚蠢「賭徒」的原因。

借貸

在2013年,我的一個朋友參與了一個需要資金的商業項目,他來找我希望獲得一筆3個月共10萬的短期貸款,後來再額外加多10萬,而他自己已投入50萬資本,當時我一直認為我的投資組合中風險最高的是股票,結果?5年後貸款尚未歸還,我們同意在2020年前可以回收第二筆十萬,不幸的是頭十萬可能永遠取不回來,更糟糕的是,我賣掉了當時手持的宏利股票去借出這筆貸款。從那時起,隨著我對股票投資的信心增加,而投資組合中的商業貸款成份變得愈來愈小。

91 標準資源控股

在2015年我有一些現金但沒有投資點子,有一個名叫周顯的金融「演員」在香港有點知名度,因為他會在報紙和雜誌上寫稿,我關注了他的facebook幾年但他不是那種你可以十分信任的人,但有時他會給你幾個驚喜的股票貼士。論壇上對他的評論很參差不齊,很多人批評他實際上是在使用一種名為「拉高出貨」的財技為仙股工作。

如果你看過那套荷里活電影《華爾街狼人》,很多上市公司都是百分百的垃圾,它們上市的目的就是欺騙投資者,例如:要求那些半知名人士在報紙上談論或者利用媒體曝光,當股票受到關注時,它的價格會上漲(拉高)並導致更多人相信,因為多數持股者都是騙局背後的老闆,一但股票價格達到對早期持有者有利可圖的水平,他們就會開始拋售它們(出貨),導致股票價格股價暴跌,留下了許多震驚的投資者,他們永遠無法收回他們的資金。我對他很懷疑,所以我決定用一些錢來測試。 2015年他不停推薦一只名為標準資源的股票,聲稱其極具潛力,在最高峰時他每週都會談到這只股票。

我閱讀了有關這家公司的一些數據,財務報告中有些可疑地方,但我很想測試最終我投資了(咳嗽......投機了)2萬5到這只股票,因為我知道即使它是垃圾我應該可以在「拉高階段」時退出。它迅速從$0.3上漲到$1.3,然後迅速回落到$0.5,我遲了加入派對但他在雜誌上非常肯定它會達到$2,所以我跳了進去,這真是非常糟糕的決定..... 後來它又反彈回到$1左右但是我並沒有把它賣掉,因為我太貪心那$2了,事實證明這家公司只是我們所謂的「老千股」,它從$1自由下跌到$0.3,慢慢再跌到到$0.1(對,是$0.1),現在只有$0.019,損失達98.1%!我沒有憤怒,因為它的價格圖表是一個完美的金融泡沫的教科書範例。我永遠不會出售這股作為我是一個白痴的提醒,至於那位作家我最近很少看到他寫股票,但是我們都知道「豹子不能改變它的斑點」,所以我仍然追蹤他(作為一種興趣),好的一面是這個教訓的成本十分低。

3. 小人:暫時表現糟糕但正在等待它轉好,或過去表現很好但最後變壞了的投資

3.1 過去表現很好但最後變壞了的投資

1246 毅信控股

到目前為止我最大的勝利,雖然我從這只股票中賺了很多錢,但同時也感到非常可惜,這家公司在打樁行業有正當業務,在我買了相當大的金額之前我做了很多關於這家公司的研究,股票在2013年上市後,它離開了其骨幹業務並將公司變成了一個金融騙局,價格從$0.5炒到$11!由於我在很早的階段已經買入了所以賺了很多錢,但我感到很遺憾管理層決定將高於平均水平的業務,變成一些由於貪婪和短視主導的金融騙局,坦白說我不介意等 10至15年才升10倍,因為這意味著它是可持續的,當一個企業可持續時,它可以走20倍30倍甚至100倍,現在價格已經下跌了99%到$0.09,公司更名為保集健康(為遠離過去及再吸引更多潛在受害者的典型伎倆)。

3.2 暫時表現糟糕但正在等待它轉好的投資

1431原生態牧業

自2013年開始我就開始關注這隻股票,乳製品行業當時處於高峰期,大量農民因擁有乳牛而變得富裕,我發現這個行業為時已晚,我知道已經錯過了行業周期。我決定不在市場炙手可熱時買,而是等待行業周期下跌。在2014年我看到了機會(至少我以為是)買入了一些股票,通常乳業的周期為2 - 3年,所以我覺得我很安全,我預計行情會在2016-2017復甦。我錯了,由於某種原因乳業需要更長的時間來恢復,由於中央政府允許更多的進口奶粉,曾經富裕的農民突然發現他們的生意處於極端低迷的狀態,中國的牛奶變得便宜到農民寧願將牛奶倒在地上,因為根本沒有買家,牛的價格急劇下降,最終股價也是如此。如果他們的報告是正確的(財務報表中的欺騙行為在中國非常普遍),該公司應該價值45億,但其市值目前低於10億。很多人聲稱這家公司是老千公司,但是我看不到任何證據表明它是(或者不是),所以我仍然是50/50,我不會買入更多它的股票,但也不會出售已買入的,直到該行業回到正常水平,我們才會得到一個公平的估價。

1314 翠華

翠華是香港一家著名的連鎖餐廳,類似於大快活和大家樂,我投資翠華的原因是因為我發現大快活和大家樂都已經在香港取得了成功,但在中國發展不了。翠華的品牌在中國大陸很受歡迎,但看起來它的股價並沒有真正反映出它的雄心,它從$6跌到$1,因為管理層有一些可疑的行為(一如既往),而且「自由行」限制令利潤率長期以來都不是太好看,而且在中國的擴張一直都進行得很慢,我不確定現實是否真的如此苛刻或只是管理層找藉口,但不管哪個情況我已經長期下注,有時需要10到20年才能建立一個品牌,明年我會再次審查。比較好的是,當股票在2013年從$3飆升至$6時,我已經賺了一筆。

CellOS Pre-IPO

我在2014年被邀請參加一個私人IPO,這是一家當時與IBM合作名為CellOS的公司。CellOS是一間通信行業的軟件解決方案公司,其客戶包括一些龐大的移動網絡運營商。2014年他們準備在美國上市,並宣稱其IPO規模將大於facebook(2014年),我的朋友有些聯繫,並被邀請購買一些上市前的股份,他也想分給我一些當時看起來將會變成不錯利潤的股票。你現在可能已經猜到的結果並不好,他們捲入了一些醜聞,有少數股東為公司的控制權而鬥爭,這筆交易變得糟透了,他們未能在美國上市,後來搬到新加坡經營而最新消息是,在2017年2月被報導問題是如此嚴重,公司可能無法生存,結果他們在2017年8月任命了一位新CEO,而現在2018年中期仍然沒有死掉。好的一面是,我和我的朋友實際上得到了股份,但是除非他們在世界某個公開市場上到市,否則我們永遠不會知道這些股票價值多少或可以賣出它們。這是一個幾乎每一天都會發生的典型投創風險故事,要麼你有幸中獎,要麼你的現金變成灰塵,在我的情況下,我仍然希望最終能夠獲得獎金。

這是一份很長的報告,我想我最好停在這裡,如果你竟然看到尾我希望你喜歡我的故事(在某種程度上有趣?),在操作這個基金的9年裡其實還有很多故事可以講,但是我要把他們留到下次繼續,也許有一天我會出本書,誰知道呢?感謝您的耐心和信任,我將在2019年再次同您見面。

最好的問候,

Calvin

p.s. 當然你可以用whatsapp及email: investment@mechcalvin.com隨時聯絡我關於你的投資