季節祝福,已經接近2017年底,對於正在學習成為一個父親的我來說2017年是混亂的一年,我還未有時間來計算最新的基金價格,但在新年之後我會寫一個年度報告總結一切。

不過今天我還是可以做一些「懺悔」,2017年有兩個名字在投資界被過分提及,他們是就是騰訊和比特幣。

截至目前,騰訊股價已經升了近一倍,在我寫這篇報告時,騰訊股價已經從$190漲到了$400左右。另外雖然比特幣是一個高度投機性的泡沫,從年頭到現在已經差不多漲了二十倍,價格由1000美元左右差點升到20000美元,但如果我們把時間延伸到比特幣被發明的2009年時,當時每個比特幣的價格只有0.003美元左右,意味著它已經升了660萬倍!這個層次在金融史上從來沒有發生過,在前互聯網時代也是絕對不可能的,當我們談到資產泡沫時,例如1637年的鬱金香狂熱之類是數十倍的升幅。世界無法想像的東西可以漲100倍,更何況600萬倍!許多重份量的投資大師已經多次警告,比特幣就像任何泡沫最終一樣會回歸到它所屬的地方 – 接近零。

無論如何,我對你們有一個好消息,一個壞消息,我會從好消息開始,其實幾年前我用基金的錢買了騰訊和比特幣,而壞消息是 - 買了他們不久之後就賣掉了...

比特幣有點情有可原,回到2013年11月,我已經知道這是一個泡沫,當時「投資」(更像投機)500美元到加密貨幣,起初我沒有買比特幣,而是買了另一種當時流行的加密貨幣叫做萊特幣,那些相信加密貨幣的人說比特幣就像黃金,而萊特幣就像白銀一樣,那時候比特幣已到達100美元左右,我認為這個價格太高了,所以我投資了大約200個萊特幣(每個大概2美元)。在2013年,比特幣經歷了第一次狂熱,比特幣價格從80美元上漲到1000美元以上,隨著加密貨幣流行,我的萊特幣也在10天內迅速從2美元跳到了55美元,我不知道升勢會維持多久,所以我沒有出售它,有一天我睡醒,泡沫破裂了,比特幣價格崩潰,每個人都在市場拋棄他們的加密貨幣,比特幣價格在一個月內下降了90%,我的萊特幣跟隨自由下跌,幸運的是我在11美元左右退出,並獲得5倍的利潤。過山車般的極端波動性另我對加密貨幣失去了興趣,所以我在120美元左右轉了去比特幣,然後把它們都賣掉了,我當時認為狂熱已經結束了。我完全錯了,如果我保留了它們,今天500美元就會變成8萬美元。

我說這是可以原諒,因為我沒有玩這個音樂椅的遊戲,我無法為比特幣估值,也無法預測它的價格,而且,這一切都感覺像贏彩票,而不是在風險計算後進行投資。其實我研究了很多關於加密貨幣的技術和經濟理論來做出這樣的結論(我從來不會根據自己的感受做決定),不管價格如何瘋狂,塊鏈技術將會改變世界,但是我不想說太多令你感到沉悶的理論,所以我只是告訴你們這個故事。如果可以把這麼多錢加進基金實在是不錯的,但這是一場危險的遊戲,所以就是這樣...

反之騰訊有點不可原諒,2014年9月份在每股$125左右買了一些它的股票,幾個月後我把它們賣了,因為我覺得它被高估了,即使今天騰訊的總市值幾乎和面書一樣,收益只有臉書的一半,但它至少是一家公司,我可以花時間做一些估價,可是我沒有。如果我不賣它,今天會有相當不錯的利潤。

正如牛頓曾經說過的:「我可以計算天體的運動,卻算不出人性的瘋狂。」如果市場上有甚麼熱手的東西,它只會變得越來越熱,直到達到一個荒謬的地步。我們可能錯過了一些機會,但是我的「安全」戰略在過去避免了許多損失,我將來有機會會解釋更多。

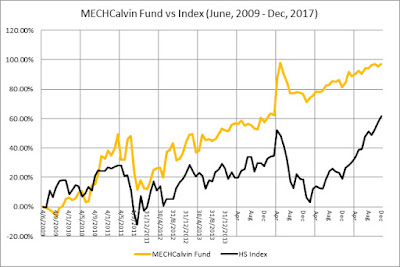

無論如何,就算無視我所做的「過錯」,基金的成績其實不壞,基金所持有的基金和股票在香港市場表現相當不錯,我覺得可能已經達到每單位$2,但不要拿我的話作準,直到我在聖誕節假期時完成所有沉悶的數學計算。

祝聖誕快樂,新年快樂

卡爾文

Season's Greetings, it is near the end of 2017, 2017 was a mess for me learning to be a father, I haven’t got time to calculate the latest fund price yet, but I will write an annual report to sum up everything after the new year.

However I still have something to “confess” today, in 2017 two names are overly mention in investment world, they are tencent and bitcoin.

Tencent is overvalued stock has almost doubled year to date, it’s stock price has risen from $190 to around $400 as we speak. While bitcoin is a highly speculative bubble that has almost twenty folded year to date, from around $1000 to just below $20000, but if we extend the timespan back to 2009 when it was first invented, it was only around $0.003 per bitcoin, meaning its price has increased 6.6 million times! This never happens in the history of finance and definitely not possible in pre-internet age, when we speak of an asset bubble, we are talking about ten folded in couple years such as the tulip mania back in 1637. The world could not imagine something can rise 100 times, let alone 6 million times! Many respectful investors have warned multiple times that bitcoin was like any bubble it will go back to where it belongs – close to zero.

Anyway, I have one good news and one bad news for you guys, I will start with good news, I have bought both tencent and bitcoin with the fund money couple years ago, and the bad news is – I have sold them not long after I bought them...

Bitcoin was a bit forgivable because I knew it is a bubble from day one, back in Nov, 2013, I have “invested” (more like speculate) USD500 into cryptocurrency, at first I didn’t buy bitcoin, I have bought another popular cryptocurrency at that time called litecoin, those who believe in cryptocurrency said bitcoin is like gold while litecoin is like silver, at that time bitcoin is around USD$100 and I thought the price is too high for my little speculative money. I have invested around 200 litecoins (around $2 each). Back in 2013, bitcoin experienced its first mania, bitcoin price increased from $80 to over $1000, hopping on the cryptocurrency bandwagon, my litecoins also quickly jumped from $2 to $55 in less than 10 days, I didn’t know how long I need to wait so I didn’t sell it, one day after I woke up, the bubble burst, the bitcoin price crashed and everyone just dumping their coins, bitcoin price dropped 90% within a month and my litecoin follow the free falling, luckily I managed to exit around $11 and made 5 times profit. After the roller coaster I have lost interested due to its extreme volatile nature, I switched to bitcoin when it was around $120 then sold them all, and I suspect the mania is over. I was so wrong, if I have kept them, the USD 500 would have become USD 80000 today.

I said it was forgivable because I didn’t play the music chair game, I could not value bitcoin, I could not predict its price and moreover, it all felt like winning a lottery rather than making an investment after some risk calculation. Well, there are a lot of technical and economic theories regarding to cryptocurrency I have studied to make such conclusion (I never make a decision based on my feelings), the block chain technology is going to change the world regardless of the craziness of its price, however I don’t want to bored you to death so I just told you the story. It would have been nice to added so much more money into the fund however it was a dangerous game to play, so that’s that…

Tencent was a bit unforgivable, I bought some of their stock back in Sept, 2014 around $125 per shares, but later I sold them because I felt it was overvalued, even today Tencent’s total market capital is almost same as facebook, its earning is only half of facebook, but at least it is a company I can spend time to do some valuation, yet I didn’t. Again if I didn’t sell it, it will have a pretty nice profit today.

As Isaac Newton once said, “I can calculate the motion of heavenly bodies, but not the madness of people.” If something is hot on the market, it tends to go hotter and hotter until it reached a ridiculous point. We might have missed some opportunity, but my “play safe” strategy has avoided many losses and I will explain more in the future.

Anyway, neglect what I have “missed”, the fund is not doing bad at all, the fund and stocks I hold perform quite well along with the HK market, but I have a feeling it has already reached $2 per unit due to the HK market’s performance, don’t take my word for it yet until I finish all the boring math during the Christmas holiday.

Have a Merry Christmas and Happy New Year

Calvin